SMC (Smart Money Concepts) trading strategy focuses on identifying market structure shifts, order blocks, and liquidity levels to anticipate price movements, offering a systematic approach to trading success․

1․1 What is SMC (Smart Money Concepts)?

SMC, or Smart Money Concepts, is a trading theory focused on understanding market dynamics through order blocks, liquidity levels, and structural shifts․ It emphasizes identifying areas where institutional traders operate, helping retail traders align with market sentiment․ By analyzing supply and demand zones, SMC provides insights into potential price movements, enabling traders to make informed decisions․ This approach is adaptable across various financial markets, offering a comprehensive framework for predicting market behavior and optimizing trade entries and exits․

1․2 Importance of SMC in Modern Trading

SMC (Smart Money Concepts) is crucial for modern traders as it provides insights into institutional trading behaviors, enabling alignment with market sentiment․ By identifying structural shifts and liquidity levels, SMC helps anticipate significant price movements, offering a predictive edge․ Its adaptability across markets makes it indispensable for traders seeking consistent results․ SMC’s focus on order blocks and demand zones ensures traders can capitalize on high-probability setups, making it a cornerstone of effective trading strategies in today’s fast-paced financial landscape․

Key Concepts of SMC Trading

SMC trading revolves around understanding market structure, order blocks, and liquidity levels․ These concepts help traders identify institutional movements, enabling strategic entries and exits aligned with market dynamics․

2․1 Market Structure and Its Role in SMC

Market structure is the cornerstone of SMC trading, revealing how institutions operate․ It identifies key levels like support, resistance, and liquidity pools, guiding traders to align with institutional flows and predict price movements effectively․ By analyzing these structures, traders can pinpoint high-probability setups, making informed decisions based on where smart money is likely to intervene․ This approach emphasizes understanding the market’s rhythm and leveraging structural insights to execute trades with precision and confidence․

2․2 Understanding Order Blocks

Order blocks are foundational to SMC trading, representing areas where institutions aggregate orders․ These zones indicate strong interest, often leading to price reversals or continuations․ By identifying these blocks, traders can anticipate market shifts, as institutions typically defend these areas․ Order blocks are categorized into bullish and bearish types, providing clear signals for entries and exits․ They are crucial for mapping market structure and executing strategies effectively, offering insights into institutional behavior and market sentiment․

2․3 Liquidity Levels and Their Significance

Liquidity levels are critical in SMC trading, representing areas where institutional players execute large orders, driving significant price movements․ These levels often coincide with order blocks and market structure shifts, making them key for anticipating reversals or breakouts․ By identifying liquidity zones, traders can set precise entry and exit points, aligning with institutional activity․ These levels also help in understanding market sentiment and potential price targets, enabling traders to capitalize on high-probability setups․ Recognizing liquidity levels is essential for executing the SMC strategy effectively, as they often dictate where price action will react or consolidate․

The SMC Entry Model

The SMC Entry Model identifies high-probability trade setups by aligning with institutional activity, focusing on market structure shifts and liquidity levels to execute precise entries and exits․

3․1 Step-by-Step Guide to SMC Entries

A Step-by-Step Guide to SMC Entries: Start by identifying market bias using order blocks and liquidity levels․ Step 1: Confirm market structure shifts․ Step 2: Locate areas of high institutional interest․ Step 3: Enter trades at key liquidity points․ Step 4: Manage risk with precise stop-loss placements․ Step 5: Target profit levels based on market structure․ This systematic approach ensures alignment with institutional activity, enhancing trading accuracy and consistency․

3․2 Identifying Bias and Market Shifts

Identifying market bias and shifts is crucial in SMC trading․ Start by analyzing market structure to determine dominance—bullish or bearish․ Look for order blocks and liquidity levels to gauge institutional interest․ A shift in bias often occurs after significant price movements or corrections․ Expansion and retracement strategies help confirm these shifts․ Monitor price action around key levels to anticipate potential reversals or continuations․ Continuous analysis of these factors allows traders to align their strategies with evolving market conditions, ensuring timely entries and exits․ This step is foundational for executing profitable trades using the SMC framework․

Advanced SMC Trading Techniques

Advanced SMC techniques involve sophisticated strategies like expansion and retracement, alongside bullish and bearish market structure analysis, enabling traders to predict price movements more accurately․

4․1 Expansion and Retracement Strategies

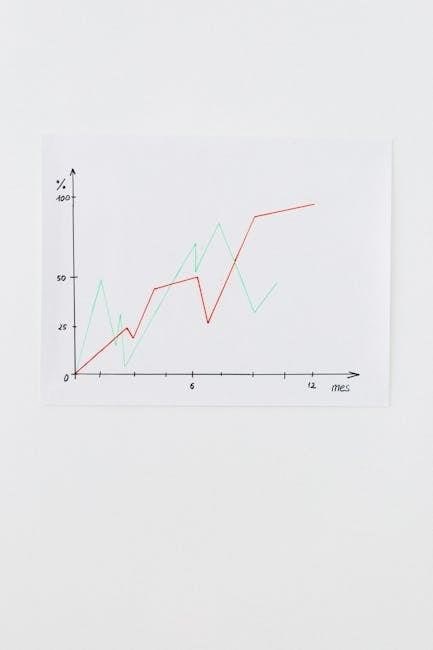

Expansion and retracement strategies in SMC trading involve analyzing price movements beyond average ranges to identify strong market impulses․ These strategies help traders predict potential price reversals or continuations by studying how prices expand from established zones of support or resistance․ Retracements are used to identify pullback points where institutional players may re-enter the market, while expansions signal areas where price action breaks out of previous constraints․ By focusing on these patterns, traders can align their entries and exits with the flow of smart money, enhancing their ability to capture profitable trades in both bullish and bearish market conditions․

4․2 Bullish and Bearish Market Structure Analysis

Bullish and bearish market structure analysis in SMC trading helps identify potential price movements by studying supply and demand zones․ A bullish structure often forms at demand zones, where buyers dominate, leading to upward price impulses․ Conversely, bearish structures emerge at supply zones, indicating selling pressure․ By analyzing these patterns, traders can predict where institutional players may enter or exit trades․ This approach focuses on identifying order blocks, liquidity levels, and market imbalances to determine the strength of a trend․ Accurate structure analysis enables traders to align their strategies with the dominant market bias, increasing the likelihood of profitable trades in both rising and falling markets․

Risk Management in SMC Trading

Risk management in SMC trading involves setting clear profit targets, stop-loss levels, and position sizing to protect capital while maximizing returns in volatile markets effectively․

5․1 Managing Risk with SMC Strategies

Managing risk with SMC strategies involves implementing disciplined approaches to protect capital and maximize returns․ Key components include setting clear profit targets and stop-loss levels to limit potential losses․ Position sizing plays a crucial role in balancing risk and potential gains․ By identifying liquidity levels and order blocks, traders can anticipate market movements and adjust their strategies accordingly․ Additionally, understanding market structure and bias helps in making informed decisions․ Effective risk management ensures that traders can withstand market volatility while maintaining consistency in their trading performance․ This structured approach is essential for long-term success in financial markets․

5․2 Setting Profit Targets and Stop Losses

Setting profit targets and stop losses is critical in SMC trading to ensure disciplined and profitable outcomes․ Profit targets should align with market structure, often placed at key liquidity levels or order blocks․ Stop losses are positioned to protect capital, typically below or above significant support or resistance zones․ These levels help traders manage risk and avoid emotional decisions․ By combining these elements, SMC strategies provide a clear framework for entering and exiting trades, enhancing overall trading consistency and performance․ This structured approach minimizes losses and maximizes potential gains, making it a cornerstone of successful trading strategies․

Tools and Indicators for SMC Trading

Essential tools for SMC trading include the Sonarlab SMC Indicator and ICT (Institutional Cycle Theory) indicators, which help identify order blocks, market structure, and liquidity levels effectively․

6․1 Sonarlab SMC Indicator Overview

The Sonarlab SMC Indicator is a powerful tool designed to help traders identify key market structures, order blocks, and liquidity levels․ It provides visual cues to anticipate potential price movements by highlighting areas where institutional traders are likely active․ The indicator simplifies the process of analyzing market dynamics, allowing traders to focus on high-probability setups․ By integrating advanced algorithms, it offers insights into market bias, expansion, and retracement phases․ This tool is particularly useful for traders implementing the SMC strategy, as it aligns with the core principles of tracking smart money flows and exploiting market imbalances effectively․

6․2 Using ICT (Institutional Cycle Theory) Indicators

ICT (Institutional Cycle Theory) indicators complement SMC strategies by identifying phases of market cycles, such as accumulation, distribution, and manipulation․ These tools help traders recognize when institutional players are entering or exiting positions, providing insights into market sentiment and potential trend reversals․ By analyzing cycle phases, traders can align their entries and exits with institutional activity, improving the accuracy of their trades․ The combination of ICT indicators with SMC principles offers a robust framework for understanding market dynamics and executing high-probability trades, making it a valuable addition to any trader’s toolkit․

Practical Examples of SMC Strategy

Explore real-world applications of SMC through the Daily MATI strategy and case studies, demonstrating how traders identify market structure shifts and execute profitable trades consistently․

7․1 Daily MATI SMC Strategy Execution

The Daily MATI SMC Strategy focuses on short-term trading opportunities, aiming to capitalize on market structure shifts within a day or a few days․ Traders identify key order blocks and liquidity levels to pinpoint potential price movements․ The strategy emphasizes risk management and precise entry/exit points, often targeting areas of high institutional interest․ By analyzing market structure and momentum, traders can anticipate expansions or retracements, ensuring profitable executions․ This approach, outlined in the SMC trading strategy PDF, provides a clear framework for identifying and exploiting high-probability trading setups in dynamic markets․

7․2 Case Studies of Successful SMC Trades

Case studies highlight successful SMC trades, showcasing how traders identified market structure shifts and executed profitable strategies․ One example involved recognizing a bullish order block at a key liquidity level, leading to a successful long position․ Another case demonstrated how retracement strategies captured significant gains during market expansions․ These real-world examples, detailed in the SMC trading strategy PDF, illustrate the effectiveness of applying Smart Money Concepts to anticipate and capitalize on institutional moves․ By analyzing these trades, learners gain practical insights into executing high-probability setups and refining their skills in identifying market opportunities․

SMC Trading Resources and Guides

Explore comprehensive resources like the SMC trading strategy PDF, books, and guides, offering insights into institutional concepts, order blocks, and advanced techniques for mastering the markets effectively․

8․1 Institutional SMC Trading Book Overview

The Institutional SMC Trading Book provides a detailed guide to advanced trading strategies, focusing on supply and demand zones, order blocks, and liquidity levels․ Authored by David Woods, this comprehensive resource is designed for Forex traders and learners, offering insights into institutional concepts․ The book outlines a 5-step strategy for identifying market structure shifts and executing high-probability trades․ It emphasizes the importance of understanding market dynamics and leveraging these insights for consistent profitability․ This book is a must-have for traders aiming to master SMC and ICT strategies, offering practical examples and actionable advice for refining their trading skills․

8․2 Mastering Advanced Trading Strategies: SMC and ICT

“Mastering Advanced Trading Strategies: SMC and ICT” by Krit Salah-ddine offers a deep dive into integrating Smart Money Concepts (SMC) and Institutional Cycle Theory (ICT)․ This book provides traders with practical strategies to identify market structure shifts, liquidity levels, and order blocks․ It bridges the gap between theory and application, offering real-world examples and actionable insights․ Designed for both novice and advanced traders, the guide emphasizes the importance of understanding institutional behavior in financial markets․ By mastering these strategies, traders can enhance their decision-making and improve profitability in dynamic market conditions․

Continuous Learning and Improvement

Continuous learning is crucial for mastering SMC trading strategies․ Staying updated with market trends, reading advanced resources like “Mastering Advanced Trading Strategies: SMC and ICT,” and adapting to evolving market dynamics ensures long-term success․

9․1 The Evolution of SMC Trading Strategies

SMC trading strategies have evolved significantly over time, adapting to market changes and technological advancements․ Initially focused on basic concepts like order blocks and liquidity levels, SMC now incorporates advanced tools such as the Sonarlab SMC Indicator and Institutional Cycle Theory (ICT)․ These innovations enhance accuracy and provide traders with a more comprehensive understanding of market dynamics․ The integration of video lessons and ongoing support in educational resources reflects the strategy’s growth, catering to both novice and experienced traders seeking refined techniques․ This evolution ensures SMC remains a powerful and relevant approach in modern trading environments․

9․2 Staying Updated with Market Trends

Staying updated with market trends is crucial for mastering SMC trading strategies․ Continuous learning through resources like the Institutional SMC Trading Book and courses on platforms like Udemy ensures traders adapt to evolving market dynamics․ The Mastering Advanced Trading Strategies: SMC and ICT book by Krit Salah-ddine provides in-depth insights, while tools like the Sonarlab SMC Indicator offer real-time market analysis․ Engaging with community forums and webinars helps traders stay informed about the latest techniques and tools, ensuring they remain competitive and effective in their trading journeys․

SMC trading strategies offer precise tools for market analysis, helping traders identify key levels and patterns to enhance profitability and consistency in their trading journeys․

10․1 Recap of Key SMC Trading Concepts

SMC trading revolves around identifying market structure shifts, order blocks, and liquidity levels to anticipate price movements․ It emphasizes understanding supply and demand zones, expansion, and retracement strategies․ By focusing on these elements, traders can systematically identify entry and exit points, enhancing their profitability․ The strategy also highlights the importance of risk management and continuous learning to adapt to evolving market trends․ These concepts collectively provide a robust framework for traders to execute informed and strategic decisions in various financial markets․

10․2 Final Thoughts on Implementing SMC Strategies

Implementing SMC strategies requires discipline, patience, and a deep understanding of market dynamics․ Traders should consistently analyze order blocks, liquidity levels, and market structure to make informed decisions․ Combining these concepts with risk management techniques ensures sustainable profitability․ Continuous learning and adaptation to market trends are crucial for long-term success․ By mastering SMC principles, traders can elevate their strategies, achieving consistent results in various financial markets․ This approach not only enhances trading skills but also fosters a mindset geared toward growth and financial independence․